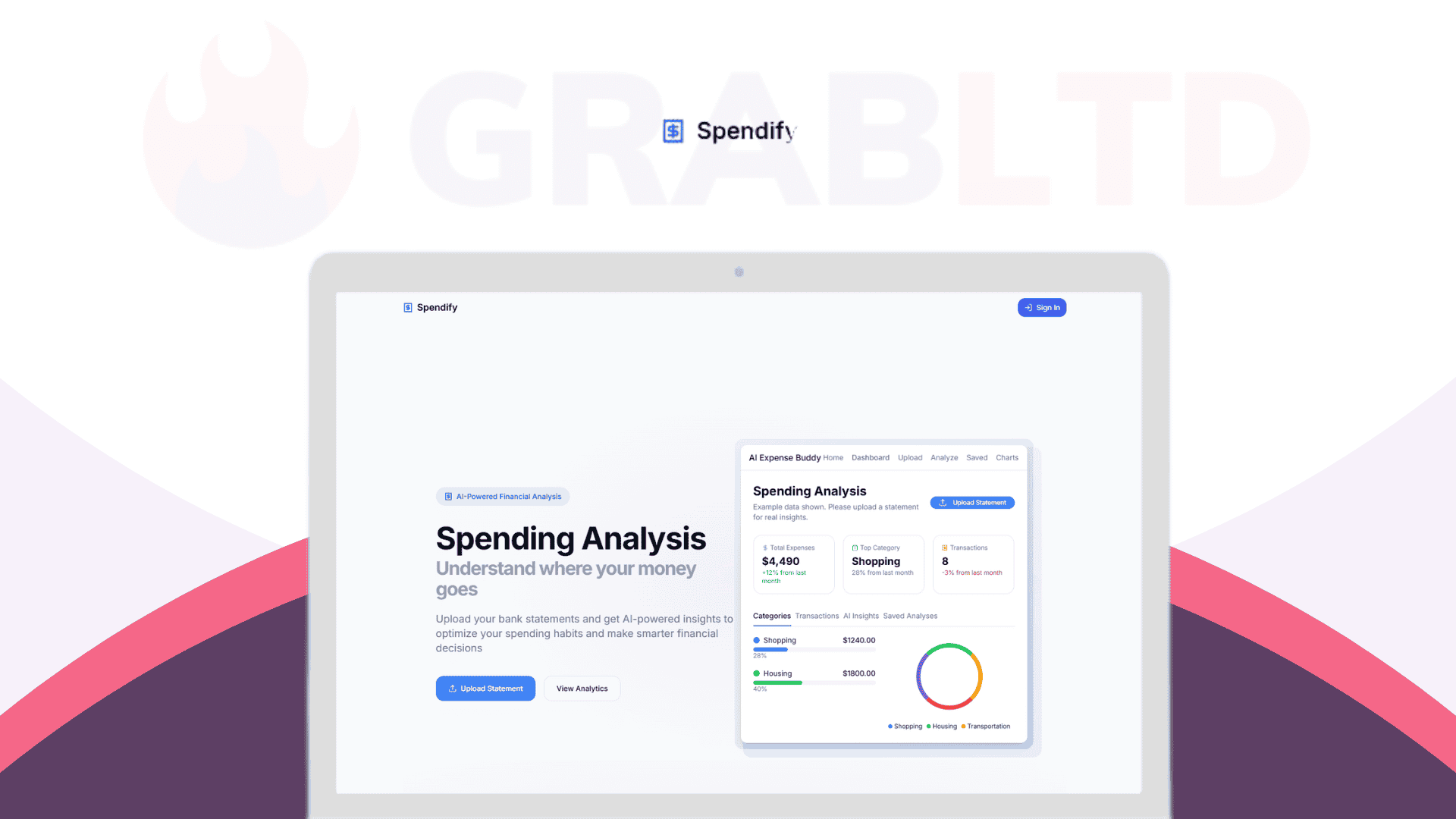

Spendify is your AI-powered financial co-pilot, designed to turn messy bank statements into crystal-clear insights.

Simply upload a PDF, CSV, or TXT file, and Spendify instantly categorizes your expenses, highlights recurring charges, scores your financial health, and surfaces smart recommendations to optimise your budget.

Our users report uncovering hidden spending leaks, cutting unnecessary costs, and gaining back both clarity and control—often within their very first month.

Unlike traditional apps that demand bank linking or endless manual entries, Spendify puts privacy first.

Your data stays yours, making Spendify the go-to solution for freelancers, professionals, and small businesses seeking clear, secure, and actionable financial insights.

With Spendify, you don’t just track money—you transform the way you relate to it. Clarity, time saved, and smarter choices start here.

👉 Ready to make your money work for you?

What Makes Spendify Different?

- Privacy-first workflow – No bank linking required; upload statements (PDF, CSV, TXT) securely and stay in control of your data.

- Smarter automation – AI automatically categorises transactions, flags recurring expenses, and highlights tax-relevant items.

- Actionable insights – Get a financial health score, personalised advice, and clear cash flow reports.

- Made for simplicity – Designed for individuals and small businesses who want clarity and control without the complexity of traditional accounting tools.

Key Features:

- Bank Statement Parsing – Upload PDF, CSV, or TXT statements and let Al auto-categorize all transactions.

- Recurring Expense Detection – Flags subscriptions and repeating charges automatically.

- Cash Flow Tracking – Visualize monthly inflows vs. outflows to stay ahead of financial health.

- Merchant Insights – See where money goes by vendor and identify top spend categories.

- Tax Analysis – Highlights tax-relevant transactions for freelancers and SMBs.

- Financial Health Score – Get a score (0-100) reflecting overall money wellness.

- Al Advisor – Ask custom financial questions and receive personalized insights.

- Budget & Goals – Set limits, create savings goals, and get notified of overspending.

- Privacy-First – No bank linking. All uploads are processed securely, with full user control.

Who’s Spendify for?

- Freelancers & Solopreneurs – Manage multiple income streams, keep expenses organised, and simplify tax preparation.

- Students & Remote Workers – Track tight budgets, monitor daily spending, and build healthy savings habits.

- Small Business Owners – Gain financial clarity without relying on complex accounting software.

- Privacy-Conscious Individuals – Anyone who wants actionable insights from their spending without the need to link a bank account.

Use Cases:

- Freelancer Tax Prep – Upload yearly statements to auto-tag tax-deductible expenses.

- Startup Cash Flow Tracking – Visualize inflows/outflows to manage runway.

- Subscription Management – Detect hidden recurring charges like Saas tools or memberships.

- Family Budgeting – Upload joint account statements for smarter household planning.